It’s divorce week here at Property, Intangible. I just reported on a case before the Supreme Court of Hawai’i that decided the relative ownership interest of divorcing spouses in copyrights created during the marriage. Now we have a case about patents, this time a federal district court case deciding standing.

The statutory sections involved are not similar, but nevertheless the district court should take a lesson from the Hawai’i court on the distinction between the legal ownership of an intangible asset and an interest in the income stream from it. The Hawai’i Supreme Court compared a copyright to a paycheck:

A paycheck issued by the employer in the name of the employee-spouse alone can be cashed, deposited, or otherwise negotiated only by that spouse; yet, the proceeds of the paycheck, representing earnings of one spouse in community, belong to the community.

The district court started out well enough, noting that, according to Enovsys LLC v. Nextel Communications, Inc., 614 F.3d 1333 (Fed. Cir. 2010), a federal court must give full faith and credit to a state’s division of assets in a divorce. It therefore held that:

the Patent was obtained while the Plaintiff and Ms. Taylor were married, and the Divorce Settlement confirms Ms. Taylor’s ownership interest in the Patent. Since Ms. Taylor has legal title to the Patent under Florida law, and has not been made a party to the action at hand, the Plaintiff lacks standing to sue for infringement.

But hold on a second, what exactly did the divorce decree say?

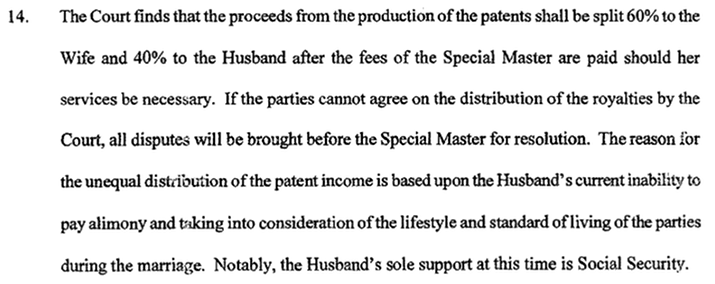

If you can’t read the image, it says

The Court finds that the proceeds from the production of the patents shall be split 60% to the Wife and 40% to the Husband after the fees of the Special Master are paid should her services be necessary. If the parties cannot agree on the distribution of royalties by the Court, all disputes will be brought before the Special Master for resolution. The reason for the unequal distribution of the patent income is based upon the Husband’s current inability to pay alimony and taking into consideration of the lifestyle and standard of living of the parties during the marriage.

I don’t know how the divorce court could have stated more clearly that the former Mrs. Taylor has only an income interest, not legal ownership, of the patents: “proceeds from the production of the patents,” “distribution of the royalties,” “patent income.” It was error on the part of the district court to confuse an award of income from the patent with legal ownership of it.

The good news is that the case is closed so the decision is immediately appealable.

Taylor v. Taylor Made Plastics, Inc., No. 8:12-CV-746-T-EAK-AEL (S.D. Fla. April 29, 2013).

Leave a Reply